Your cart is currently empty!

Tips for Paying Off Car Loans Quicker

Want to free yourself from those monthly car payments faster? It’s a common goal for many car owners, and luckily, there are proven strategies that can help you achieve this. This article will guide you through effective tips for paying off your car loan quicker, putting you back in the driver’s seat of your finances.

Understanding Your Car Loan

Before diving into strategies, it’s crucial to grasp the fundamentals of your car loan.

- Loan Term: This refers to the length of your loan, typically ranging from 36 to 84 months. Shorter loan terms often mean higher monthly payments but lower overall interest paid.

- Interest Rate: This is the percentage charged by the lender on the amount borrowed. A lower interest rate translates to less money spent on interest over the life of the loan.

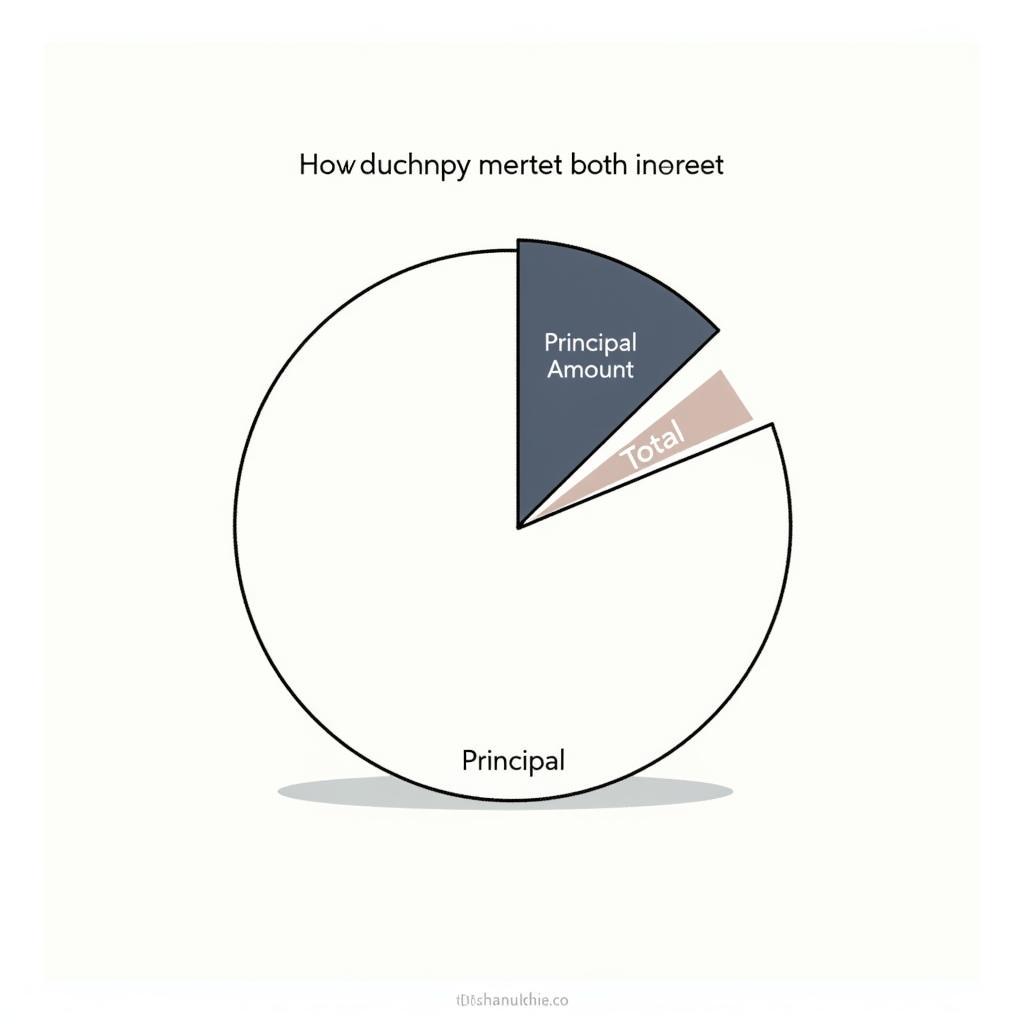

- Principal and Interest: Each monthly payment is split between paying down the principal (the original loan amount) and the accrued interest.

Car Loan Components Illustration

Car Loan Components Illustration

Effective Tips to Pay Off Your Car Loan Faster

1. Make Bi-Weekly Payments

Instead of making one monthly payment, switch to bi-weekly payments. By making half your monthly payment every two weeks, you’ll end up making an extra full payment each year, significantly reducing the principal and saving on interest charges in the long run.

2. Round Up Your Payments

Even a small increase in your monthly payment can make a difference. Consider rounding up your payment to the nearest $50 or $100. This extra amount goes directly towards the principal, accelerating the loan payoff process.

3. Make Lump-Sum Payments When Possible

Whenever you receive extra funds, like a work bonus, tax refund, or inheritance, consider putting a portion or all of it toward your car loan as a lump-sum payment. These extra payments directly chip away at the principal, leading to substantial interest savings and a faster payoff timeline.

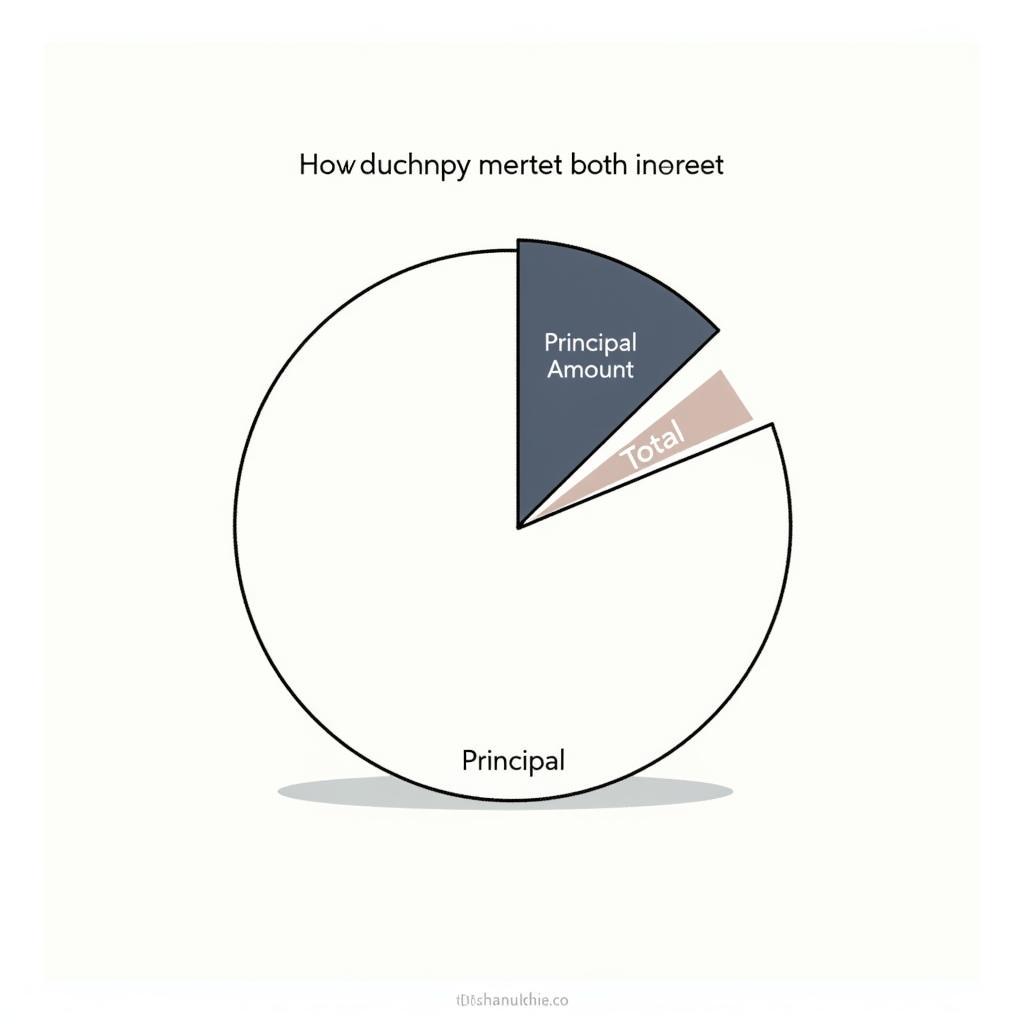

Extra Car Loan Payments Illustration

Extra Car Loan Payments Illustration

4. Refinance for a Lower Interest Rate

If interest rates have dropped since you took out your loan or if your credit score has improved, explore refinancing options. Refinancing to a lower interest rate can save you money on interest charges over the life of the loan.

5. Avoid Skipping Payments

While it might seem tempting to skip a payment when facing a tight financial month, doing so can have negative consequences. Skipping payments can lead to late fees, damage your credit score, and prolong the life of your loan.

6. Negotiate with Your Lender

Don’t hesitate to contact your lender if you’re facing financial difficulties. They might be willing to work with you by offering temporary forbearance, adjusting your payment plan, or exploring other options.

Quicker Car Loan Payoff: Benefits You’ll Enjoy

- Save Money on Interest: The faster you pay off your loan, the less interest you’ll accrue, saving you a significant amount in the long run.

- Build Equity Faster: Paying off your car loan quickly builds equity in your vehicle, which can be beneficial if you decide to sell or trade it in later.

- Reduce Financial Stress: Eliminating your car payment frees up your cash flow, reducing financial stress and providing greater financial flexibility.

Conclusion

Paying off your car loan faster is an achievable goal with the right strategies. By understanding your loan terms, exploring different repayment options, and adopting disciplined financial habits, you can accelerate your journey toward becoming debt-free and enjoy the financial freedom that comes with it. Remember, even small changes can make a big difference over time.

Leave a Reply