Your cart is currently empty!

First Time Car Buyer Loans: Your Guide to Success

Navigating the world of car loans can seem daunting, especially for first-time car buyers. With so many options, terms, and interest rates to consider, it’s easy to feel overwhelmed. But fear not, this comprehensive guide is here to equip you with the knowledge and tips you need to secure a favorable loan and drive away in your dream car.

Understanding Your Financial Landscape

Before you even begin browsing car dealerships, take the time to assess your financial situation. Determine how much you can realistically afford to spend on car payments each month without straining your budget. Consider your income, expenses, and existing debts. Remember to factor in additional costs like insurance, fuel, and maintenance.

First Time Car Buyer Creating a Budget

First Time Car Buyer Creating a Budget

Building a Solid Credit History

Your credit score plays a crucial role in determining the interest rates you’ll qualify for. A higher credit score typically translates to lower interest rates and more favorable loan terms. If you have limited credit history, consider becoming an authorized user on a responsible family member’s credit card or taking out a small loan and making timely payments to build a positive track record.

Exploring Loan Options for First-Time Car Buyers

First-time car buyers often have various loan options available to them, including:

-

Secured Car Loans: These loans use the vehicle you’re purchasing as collateral. They generally offer lower interest rates compared to unsecured loans but require a down payment.

-

Unsecured Car Loans: These loans don’t require collateral but typically come with higher interest rates, especially for borrowers with limited credit history.

-

Dealer Financing: Some dealerships offer in-house financing options. While convenient, it’s essential to compare these offers with rates from banks and credit unions to ensure you’re getting a competitive deal.

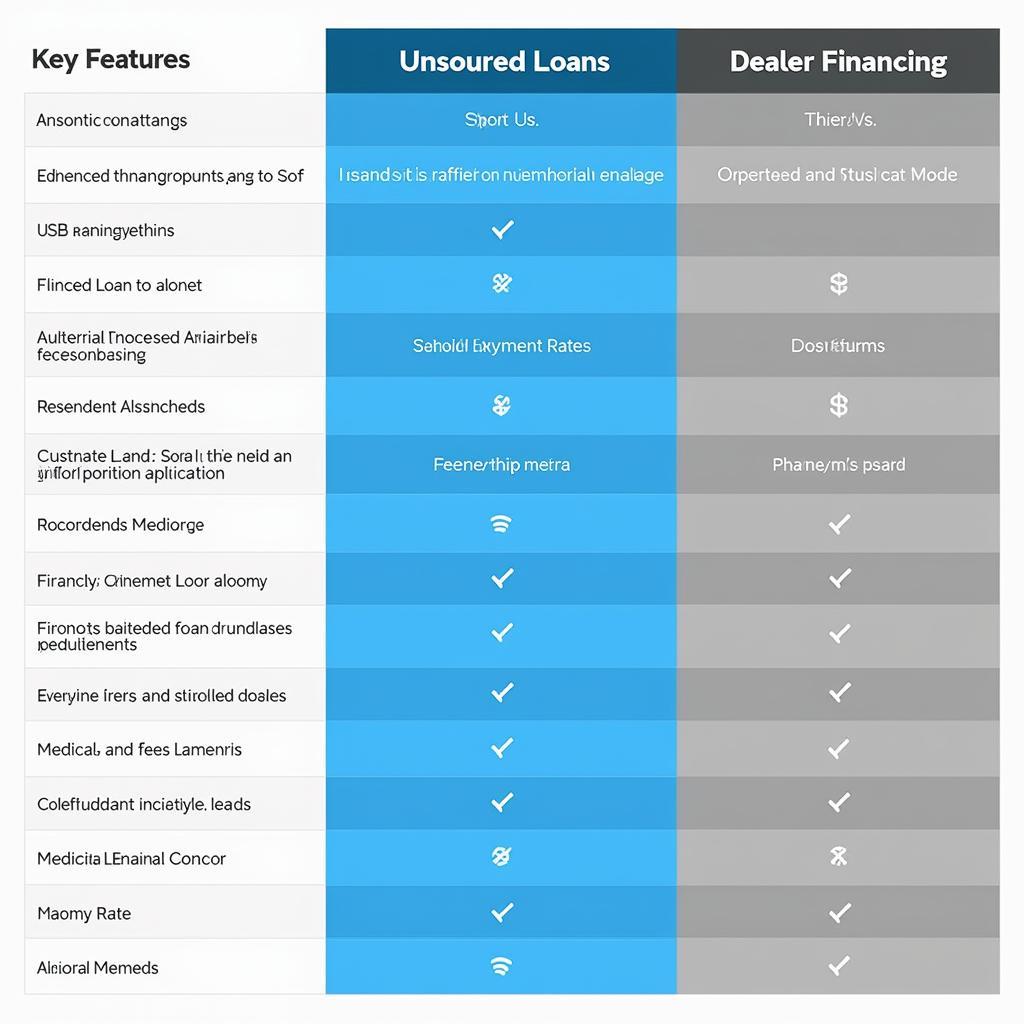

Comparing Car Loan Options

Comparing Car Loan Options

Tips for Securing the Best Loan Terms

When shopping for a car loan, follow these tips to increase your chances of getting favorable terms:

-

Shop Around and Compare Offers: Don’t settle for the first loan offer you receive. Get quotes from multiple lenders, including banks, credit unions, and online lenders, to compare interest rates, loan terms, and fees.

-

Negotiate Loan Terms: Don’t be afraid to negotiate with lenders. You might be able to secure a lower interest rate or waive certain fees.

-

Make a Larger Down Payment: A substantial down payment can lower your monthly payments and reduce the total interest paid over the life of the loan.

-

Opt for a Shorter Loan Term: While shorter loan terms usually come with higher monthly payments, you’ll pay less interest overall.

-

Understand Loan Fees and Charges: Pay close attention to loan fees, such as origination fees, documentation fees, and prepayment penalties, as these can add to the overall cost of borrowing.

Protecting Yourself From Predatory Lending

As a first-time car buyer, it’s essential to be aware of predatory lending practices. Avoid lenders who:

-

Pressure you into a loan: Reputable lenders will take the time to explain your options and answer your questions without pressuring you.

-

Offer loans with terms you don’t understand: Make sure you fully understand all loan terms and conditions before signing on the dotted line.

-

Promise guaranteed approval regardless of credit: Legitimate lenders will always check your credit history.

Conclusion

Securing a car loan as a first-time buyer doesn’t have to be overwhelming. By understanding your financial situation, building good credit, exploring your loan options, and following these expert tips, you can navigate the process with confidence and drive away in the car of your dreams.

Leave a Reply