Your cart is currently empty!

First Car Tips: Your Ultimate Guide to Hitting the Road

Buying your first car is a significant milestone. Whether you’re a teen eager for freedom or an adult finally making the purchase, First Car Tips can make all the difference between a smooth ride and a bumpy start. This guide will cover everything you need to know, from budgeting and choosing the right car to insurance and maintenance.

Budgeting for Your First Car

Before you even start browsing car dealerships, it’s crucial to determine your budget. First car tips often overlook the importance of a realistic budget, but it’s the foundation of a smart purchase. Consider not just the sticker price, but also insurance, gas, maintenance, and potential repairs. A good rule of thumb is to keep your total car expenses under 15% of your monthly income.

Budgeting for Your First Car

Budgeting for Your First Car

Factor in All the Costs

Many first-time buyers focus solely on the down payment and monthly loan payment. However, buying a first car tips emphasize the importance of factoring in all associated costs. These include:

- Insurance premiums

- Fuel costs

- Regular maintenance (oil changes, tire rotations, etc.)

- Unexpected repairs

- Registration fees

Saving for Your Down Payment

A larger down payment translates to lower monthly payments and less interest paid over the life of the loan. Start saving early and consistently. Even small amounts add up over time.

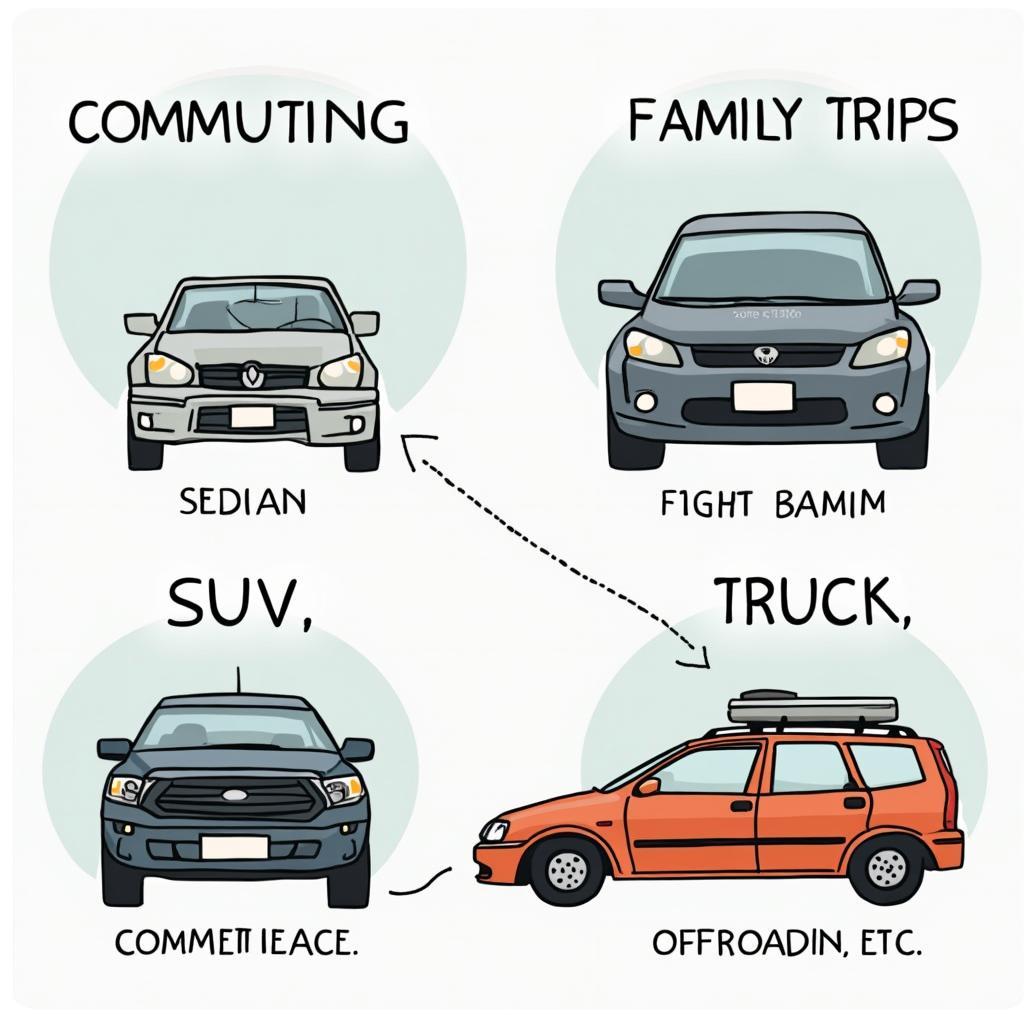

Choosing the Right Car

With your budget in mind, start researching cars that fit your needs and lifestyle. Are you primarily driving in the city or on the highway? Do you need a lot of cargo space? Consider these factors when choosing your first vehicle. first car tips us offer a regional perspective on car selection, considering factors like climate and local driving conditions.

Choosing the Right Car

Choosing the Right Car

New vs. Used: Which is Right for You?

Both new and used cars have their pros and cons. New cars come with warranties and the latest features, but they depreciate quickly. Used cars are more affordable but may require more maintenance.

“When advising first-time buyers, I always stress the importance of research,” says automotive expert, Amelia Carter. “A well-maintained used car can be a great value, but a thorough inspection is essential.”

Researching Reliability and Safety

Look up safety ratings and reliability reports from reputable sources like the National Highway Traffic Safety Administration (NHTSA) and Consumer Reports.

Insurance and Financing

Car insurance is a legal requirement in most places. Shop around for quotes from different insurers to get the best rate. first car tips woolworths sometimes offers helpful resources for comparing insurance options.

Car Insurance and Financing

Car Insurance and Financing

Understanding Insurance Coverage

It’s essential to understand the different types of car insurance coverage, including liability, collision, and comprehensive.

Securing a Car Loan

If you’re financing your car, get pre-approved for a loan before heading to the dealership. This will give you a clear idea of how much you can afford and strengthen your negotiating position.

Maintenance and Safety Tips

Regular maintenance is key to keeping your car running smoothly and safely. first car tips uk often provide region-specific advice on car maintenance, taking into account the local climate and road conditions.

Regular Checkups

Follow the manufacturer’s recommended maintenance schedule for oil changes, tire rotations, and other essential services.

“Preventative maintenance is always less expensive than major repairs,” advises veteran mechanic, David Miller. “Sticking to a regular maintenance schedule can save you money and headaches in the long run.”

Conclusion

Buying your first car is an exciting experience. By following these first Car Tips, you can navigate the process with confidence and make an informed decision that sets you up for years of happy driving. Remember to budget wisely, choose a car that suits your needs, secure the right insurance, and prioritize maintenance for a safe and enjoyable driving experience.

FAQ

- How much should I budget for my first car?

- What are the pros and cons of buying a new vs. used car?

- What type of car insurance do I need?

- How can I get the best interest rate on a car loan?

- What are some essential car maintenance tips?

- Where can I find reliable car safety ratings?

- How do I negotiate the price of a car?

Need more help?

Check out these other articles on our website:

Contact us for further assistance via WhatsApp: +1(641)206-8880, Email: [email protected], or visit us at 456 Pine Avenue, Toronto, ON M5V 2J4, Canada. Our customer support team is available 24/7.

Leave a Reply