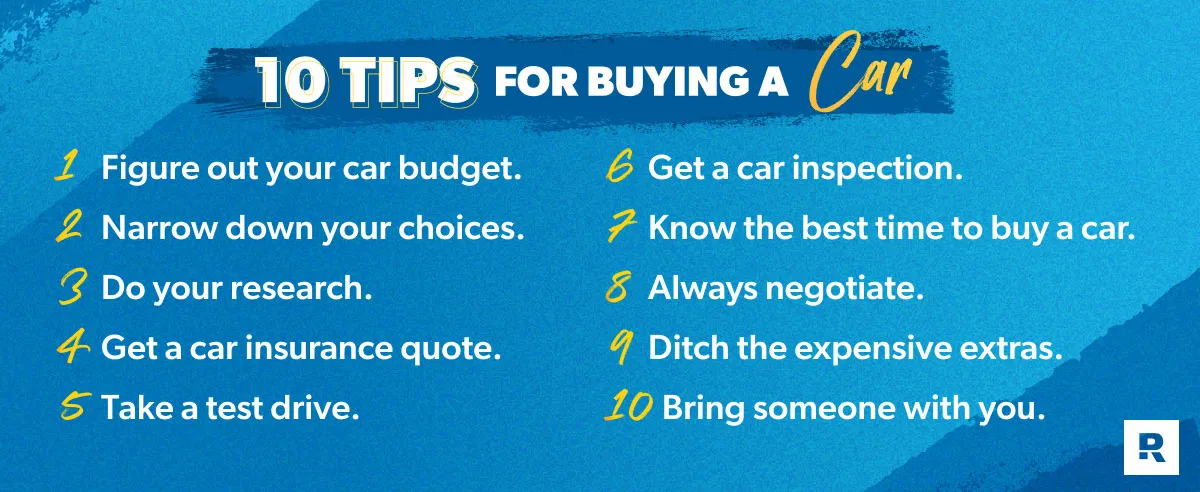

Buying a car can feel overwhelming. With so many options and financial considerations, it’s easy to make a mistake that costs you big time. Dave Ramsey’s approach to car buying focuses on avoiding debt and making smart financial choices. These Dave Ramsey Car Buying Tips will guide you toward a reliable and affordable vehicle without wrecking your budget.

1. Calculate Your Car Budget

A key principle of Dave Ramsey’s plan is to avoid debt. New cars depreciate rapidly, losing a significant portion of their value within the first few years. Unless you’re wealthy, buying used is generally the wiser choice.

Determine how much you can realistically afford to pay for a car upfront in cash. Taking out a car loan is not an option. Save until you have the cash needed to purchase a vehicle outright.

If you don’t have the funds immediately available, create a budget and identify areas where you can cut expenses and allocate money towards your car fund. This approach ensures you own the car outright and avoid the burden of debt. Remember, leasing or financing a car is not a path to building wealth.

2. Narrow Your Vehicle Choices

Once you’ve established your budget, start researching vehicles that align with your price range. Explore used car listings on dealership websites and platforms like Craigslist. Narrow down your options based on factors like safety, fuel efficiency, reliability, and suitability for your needs.

While a sporty car might be appealing, a minivan may be the more practical choice for a family. Prioritize practicality and financial sense over emotional desires when selecting a vehicle.

3. Conduct Thorough Research

Used Car on a Lot

Used Car on a Lot

Before making a decision, conduct thorough research on your shortlisted vehicles. Check the Kelley Blue Book (KBB) value to ensure the asking price is fair for the vehicle’s year and model. Obtain the Vehicle Identification Number (VIN) and use websites like VehicleHistory.com or Carfax.com to access the vehicle’s history report. This report reveals accident history, repair records, potential recalls, and other vital information.

While comprehensive reports may come at a cost, even free reports can alert you to major red flags. Addressing potential issues upfront can save you from costly repairs down the line.

4. Get a Car Insurance Quote

Car insurance costs can vary significantly depending on the vehicle you choose. Before committing to a purchase, obtain insurance quotes for each vehicle you’re considering. Consult your current insurance agent or an independent agent to shop around and find the best rate.

Unexpectedly high insurance premiums can impact your overall budget, so factor this into your decision-making process.

5. Test Drive the Car

Test driving the car is an essential step. Before visiting a dealership, know exactly what you want and stick to it. Car salespeople can steer you towards more expensive models with unnecessary features.

During the test drive, choose a route that allows you to experience different driving conditions. Pay attention to any unusual noises, rattles, or handling issues. Document any observations to discuss during negotiations.

6. Get a Pre-Purchase Car Inspection

Before finalizing the purchase of a used car, take it to a trusted mechanic for a comprehensive inspection. While the car may appear to be in good condition during a test drive, underlying mechanical issues may not be immediately apparent.

A pre-purchase inspection can reveal hidden problems and provide valuable insights into the car’s overall condition. If the seller hesitates or refuses to allow an inspection, consider it a red flag.

7. Know the Best Time to Buy

Deals can be found during holiday weekend sales, at the end of the month, and at the end of each quarter, when salespeople are motivated to meet quotas. Late summer, dealerships often aim to clear space for newer models. Year-end sales also offer opportunities for discounts.

While the used car market can fluctuate, timing your purchase strategically can still result in significant savings.

8. Always Negotiate

Armed with research and paying with cash, you’re in a strong position to negotiate the car’s price. Start by offering a lower price than what you’re willing to pay, leaving room for negotiation. Highlight any issues identified during the test drive or inspection.

Be prepared to walk away if the seller is unwilling to meet your price. Dealerships want to make the sale. Making it clear that you’re paying cash and uninterested in financing can give you leverage.

9. Avoid Expensive Extras

When buying a car, resist the temptation to add unnecessary extras such as roof racks, chrome rims, or premium sound systems. These dealer-added options can significantly inflate the car’s price. Politely decline these add-ons to keep costs down.

Similarly, avoid purchasing an extended warranty. If you have a fully funded emergency fund, you’re better off using those funds for any unexpected repairs.

10. Bring Someone With You

Having a friend or family member accompany you can be invaluable, especially if you’re inexperienced in car buying. A second opinion can help you stay within your budget, spot potential issues, and negotiate effectively.

Stay on Track with Your Budget

A vehicle’s main purpose is transportation. Avoid the temptation to purchase a car you can’t afford to impress others.

Save up and pay cash. A budget is essential for managing your finances and saving for a car. Using a budgeting app like EveryDollar makes it easy to track your spending, allocate funds, and achieve your savings goals.