Your cart is currently empty!

17 Year Old Car Insurance Tips: Navigating the Road Ahead

Getting your driver’s license at 17 is a huge milestone, but the thrill of freedom comes with the responsibility of car insurance. Navigating the world of insurance can feel overwhelming, especially for new drivers. This guide will equip you with essential 17 Year Old Car Insurance Tips to help you find the best coverage at the most affordable price.

Understanding the Basics of Car Insurance for 17 Year Olds

As a 17-year-old driver, you’re statistically more likely to be involved in an accident than older, more experienced drivers. This translates to higher insurance premiums. Understanding why this is the case is the first step to finding affordable coverage. Insurers consider factors like your age, driving experience, and the type of car you drive when calculating your premium. It’s important to shop around and compare quotes from different insurers to find the best deal.

17 Year Old Car Insurance Tips: How to Save Money

There are several strategies you can employ to lower your car insurance costs. One effective method is to maintain good grades. Many insurance companies offer discounts to students with a high GPA. Another valuable tip is to complete a driver’s education course. These courses not only improve your driving skills but also demonstrate your commitment to safe driving to insurers, often leading to discounts.

Choosing the right car also impacts your insurance premium. Opting for a safer, less powerful car can significantly reduce your costs. Avoid sports cars or high-performance vehicles as these are typically more expensive to insure. Another strategy is to stay on your parents’ policy. While adding a teen driver increases the overall premium, it is often cheaper than a separate policy for a young driver.

Finding the Right Coverage: Liability, Collision, and Comprehensive

Navigating different coverage options can be confusing. Liability coverage is legally required in most states and covers damages you cause to others in an accident. Collision coverage pays for damage to your own vehicle in the event of an accident, regardless of fault. Comprehensive coverage protects your car from non-collision incidents like theft, vandalism, or natural disasters.

Different Types of Car Insurance Coverage Explained

Different Types of Car Insurance Coverage Explained

Tips for Getting Car Insurance Quotes as a 17 Year Old

When getting quotes, be prepared to provide information about your driving history, the car you’ll be driving, and your address. Accuracy is crucial, as providing false information can invalidate your policy. Compare quotes from multiple insurers, both online and through independent agents. This ensures you’re getting the most competitive rate. Don’t be afraid to ask questions. A good insurance agent can explain the different coverage options and help you find the best policy for your needs.

Keeping Your Insurance Costs Low Over Time

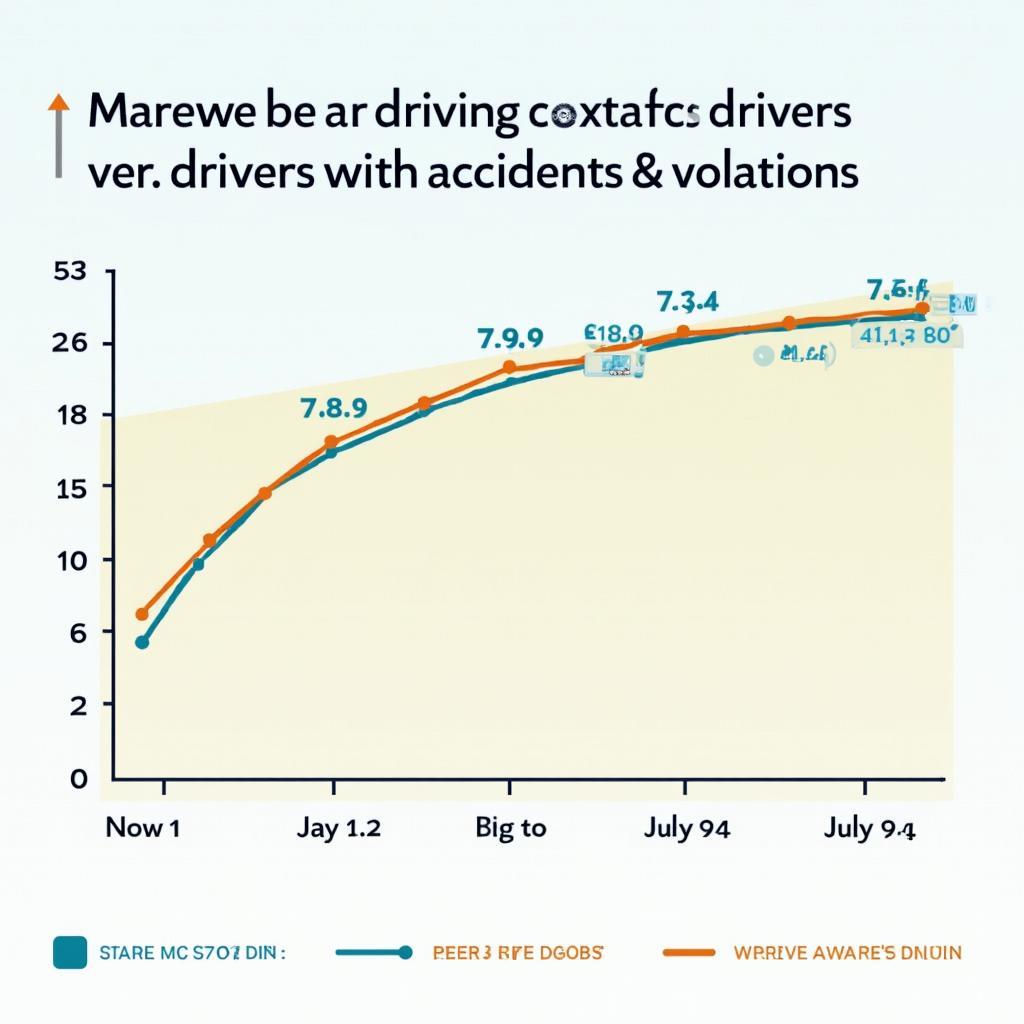

Once you have your insurance, maintaining a clean driving record is key to keeping your premiums low. Avoiding accidents and traffic violations demonstrates responsible driving habits and can lead to lower rates over time. Similar to [18 tips to save money on car insurance], consistent safe driving habits contribute to significant savings. For new drivers, consider starting with a higher deductible, which is the amount you pay out-of-pocket before your insurance kicks in. This can lower your premium, but be sure you can afford the deductible if you do need to make a claim. Remember, 17 year olds car insurance tips are constantly evolving, so stay informed about new discounts and programs.

Strategies to Maintain Low Car Insurance Premiums Over Time

Strategies to Maintain Low Car Insurance Premiums Over Time

Conclusion: Driving Smart with the Right Insurance

Getting car insurance as a 17-year-old requires careful consideration and research. By following these 17 year old car insurance tips, you can navigate the complexities of insurance and find affordable coverage that meets your needs. Remember, safe driving habits and smart choices are the best ways to keep your insurance costs low and enjoy the freedom of the open road.

FAQ

- What is the average cost of car insurance for a 17-year-old? (The average cost varies depending on location, driving history, and the type of car, but it’s typically higher than for older drivers.)

- Can I get insurance without a driver’s license? (No, you need a valid driver’s license to get car insurance.)

- How can I get discounts on my car insurance? (Good grades, driver’s education courses, and choosing a safe car can often lead to discounts.)

- What is the difference between liability, collision, and comprehensive coverage? (Liability covers damages you cause to others, collision covers damage to your own car, and comprehensive covers non-collision incidents.)

- Do I need my own insurance policy if I’m on my parents’ policy? (You’re generally covered under your parents’ policy if you’re listed as a driver, but it’s always best to confirm with your insurance company.)

- What happens if I get into an accident without insurance? (Driving without insurance can result in significant fines, license suspension, and even jail time.)

- How often should I review my car insurance policy? (It’s a good idea to review your policy annually or whenever your circumstances change, such as buying a new car or moving to a new address. Much like researching [tips renting a car in wales 2017] before a trip, reviewing your policy regularly ensures you have the right coverage.)

Common Car Insurance Scenarios for 17-Year-Olds

- Scenario 1: A 17-year-old gets their first speeding ticket. (This will likely increase their insurance premium. Attending traffic school may help mitigate the increase.)

- Scenario 2: A 17-year-old is involved in a minor fender bender. (Depending on the severity and who is at fault, their insurance premium may increase. Having collision coverage would help cover the cost of repairs to their vehicle. This emphasizes the importance of [new car insurance tips] for young drivers.)

- Scenario 3: A 17-year-old’s car is vandalized in a parking lot. (If they have comprehensive coverage, their insurance would help cover the cost of repairs.)

If you need further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 456 Pine Avenue, Toronto, ON M5V 2J4, Canada. We have a 24/7 customer support team. You may also find helpful information in our articles on [Car Tips for the new year].

Leave a Reply